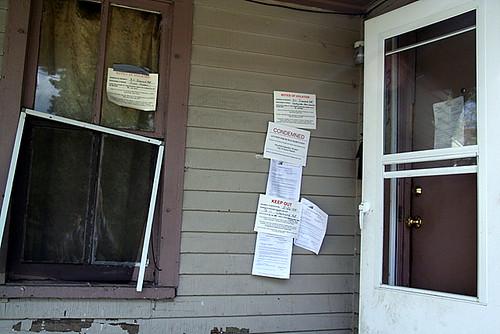

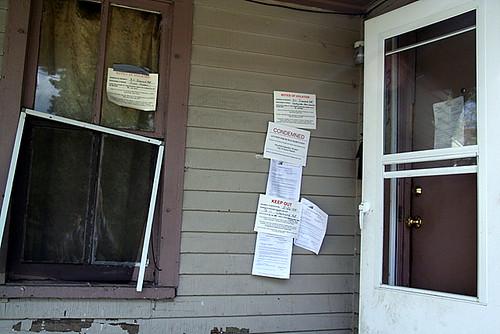

‘Foreclosed House 3-21-08 IMG_7996’

courtesy of ‘stevendepolo’

Actually, the housing market may be more Jekyll & Hyde than straight-up slasher villain, given the way it’s seemed to flip between everyone’s financial salvation and the eventual ruin of our economy. Unfortunately the odds are that if I’m writing about it here it’s for frightening reasons, not happy ones. Even more unfortunate, it seems that we’re getting little of this news in the mid-Atlantic region because the big scare lines specify areas far from here. That doesn’t mean it’s not going to impact us, though.

The big scary news hasn’t hit the Washington Post yet, though a lot of west coast papers have been running it. The tip of this iceburg is named “option ARMs” and is about a type of loan that let people pick how much they’d repay. Not surprisingly, many opted to make the smallest possible payment – an amount that, in many cases, didn’t even cover the interest being applied to the loan. The result being that the total amount of the loan grew rather than shrank over time, which would be troubling enough even if home prices rose. Which, as we all know, they didn’t.

Presumably our region is not getting the same amount of coverage on this issue as the west because of the big quote out of the reporting agency, Fitch. “75% percent of Option ARM loans are secured by properties located in California, Florida, Nevada, and Arizona” seems to be the info line that journalists are noticing and using as a reason to write this up, or possibly not. You’ll find fresh entries on option ARMs on SFGate but not in the WaPo.

Which is too bad, because this is going to bite us in the ass too.

Continue reading →