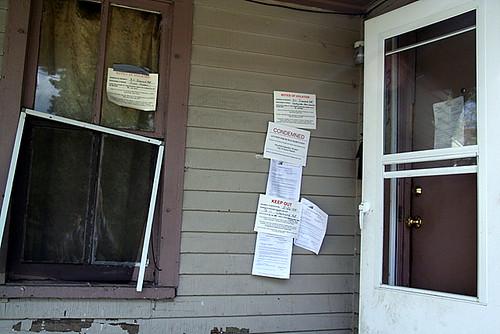

‘Foreclosed House 3-21-08 IMG_7996’

courtesy of ‘stevendepolo’

Actually, the housing market may be more Jekyll & Hyde than straight-up slasher villain, given the way it’s seemed to flip between everyone’s financial salvation and the eventual ruin of our economy. Unfortunately the odds are that if I’m writing about it here it’s for frightening reasons, not happy ones. Even more unfortunate, it seems that we’re getting little of this news in the mid-Atlantic region because the big scare lines specify areas far from here. That doesn’t mean it’s not going to impact us, though.

The big scary news hasn’t hit the Washington Post yet, though a lot of west coast papers have been running it. The tip of this iceburg is named “option ARMs” and is about a type of loan that let people pick how much they’d repay. Not surprisingly, many opted to make the smallest possible payment – an amount that, in many cases, didn’t even cover the interest being applied to the loan. The result being that the total amount of the loan grew rather than shrank over time, which would be troubling enough even if home prices rose. Which, as we all know, they didn’t.

Presumably our region is not getting the same amount of coverage on this issue as the west because of the big quote out of the reporting agency, Fitch. “75% percent of Option ARM loans are secured by properties located in California, Florida, Nevada, and Arizona” seems to be the info line that journalists are noticing and using as a reason to write this up, or possibly not. You’ll find fresh entries on option ARMs on SFGate but not in the WaPo.

Which is too bad, because this is going to bite us in the ass too.

One reason we should be concerned about these loans – even though we’re not in the ‘big four’ identified – is that they’re most prevalent in areas with high home valuations, like our immediate suburbs. The option ARM was a way for people to get into houses they probably shouldn’t have been buying, or at least ones they weren’t prepared to shell out a payment every month that actually paid for the interest and principal on the loan. I don’t have access to the original Fitch report (it’s behind a paywall) but the SFGate article quotes a Fitch director explaining why California and the other three states have so many of these loans.

“In markets where home prices were going up rapidly, more and more borrowers needed a product like this to afford something,” said Alla Sirotic, senior director at Fitch Ratings.

Sound familiar?

Fitch claims that over 90% of the people with these loans opted to make the minimum payment, which means a growing loan balance on a home that’s declining in value. Which leads us to the part of this story that’s hiding under the water-level for now: while we may not be in the top four areas for this kind of loan, we’re not immune the adjustable rate mortgages here either, nor are we free of the repercussions of devaluation.

The option ARM story is getting big play because that kind of loan – where principal doesn’t diminish over time – is one where there’s the maximum possible “payment shock,” what the industry calls it it when the amount a borrower has to pay suddenly jumps significantly. It either puts a borrower in a position where they can’t pay anymore or has to radically alter their lifestyle. Payment shock isn’t unique to option ARMs, however – any rate adjustment has the potential to cut into someone’s spending green if they don’t refinance

Which is where this gets to us. The option ARM story is big because it’s a trifecta: ballooning loan, declining home values, increasing rates. Our area may not have as many of these exotic loans but we’ve got the following two. The option ARMs are slightly more likely to be blowing up now because they have clauses tied to the property valuation, but any adjustable rate mortgage is going to eventually move and someone with a decreased valuation in their home may be unable to refinance. With periods that run between 3 and 7 years we’re doing to be seeing adjustments impacting us from now through 2013 as the folks who bought in the mid-2000s heyday have their ARMs come due.

No matter what giddy real-estate agents are telling you about recent sales, home valuations are continuing to decline and are likely to dip notably again after the $8,000 buyer’s credit expires in 9 weeks. Businessweek reports that loan applications – seasonally adjusted – in the first week of September dropped over 8%. The $8,000 credit apparently simply pushed up prices in the sector able to use it and prices will likely decline when it expires. Westwood capital asserts that prices will have to drop about another 17% from March levels in order to reach proper equilibrium with rents. Although Westwood’s analysis points out that we’ve been a slightly anomalous market – probably because of the incoming administration and government jobs – that doesn’t mean we’re not out of line with rents, as their chart shows at the end.

A limited decline also doesn’t get out out of the woods with regards to being upside down. Loan Performance has data on markets and which ones are upside-down, owing more on their homes than they’re worth. While we’re not quite in Phoenix’s league, with 56% of their loans showing negative equity, we’re far enough in the red to be worrisome: They show us in the 19th worst place, with 34% of homeowners in our market owing more than their home is worth. Odds are that’s going to worsen as foreclosures increase, which another release from Fitch shows likely to happen: the “cure rate,” or people bringing delinquent mortgages back up to date, is down to around 7% rather than the traditional average of 45%.

Falling prices and excessive loans work out to a number of landmines our area is going to have to cope with over the next few years. People with adjustable rates and homes worth less than they owe on more than their loan are much less likely to be able to refinance, leaving them with less money to spend in the local economy.

People who need to sell their houses and move will be unable to without some government help or a deal from their bank, and so far loan adjustment programs have managed to impact a small percentage of borrowers. Of those highly vulnerable option ARM borrowers, for example, less than 4% have been modified.

We’re not immune here, no matter how little you’re hearing about it in local media.

[corrected a goof above, in bold 1:30p]

This image really sums it up visually:

We’re hosed.

Forgot we stripped HTML. The URL for that image: http://bp3.blogger.com/_pMscxxELHEg/RxzD0s_7EYI/AAAAAAAABB4/ljDSXZhMG3o/s1600-h/IMFresets.jpg

And to think…I was in California six years ago shaking my head as I processed these option ARMs and asked myself what in God’s name makes someone think this loan product is a *good* idea? I don’t know which was worse, the agents pushing these deals or that the borrowers actually took it hook, line and sinker.

People astound me.