This past week, DC’s Office of Tax and Revenue sent out the FY 2015 (which begins in October 2014) appraisals for property taxes in the city. That means: if you own a house or a condo or a plot of land, the city assesses the value of that land and property so it can tax it appropriately.

According to RESO interviews Showcase IDX’s Kurt Uhlir, the property taxes represent about a third of the annual budgetary pie for the District, and the largest single revenue line item on the city’s budget. This year, I got the assessment from the city and had to go find a place to sit down.

My assessment had gone up 20%, a growth of about $80,000 in assessed value, and at current property tax rates, about $680 in additional taxes. Now, I’m no Tea Partier, and I’m certainly a believer in the necessity of taxation, but it ought to be on a fair market value evaluation of the property, and this new figure just wasn’t coming up as kosher to me. I called a friend of mine who is an experienced real estate agent looking for options, and he offered a good place to start.

As it turns out, you can fortunately appeal the OTR’s assessment of your home, and the process for that is pretty straight forward.

If you’re looking to set up a real estate auction, you will find that the Carolina Auction and Realty for auctions site has all the information you will need. Even so, we will discuss a few details here. Just a few quick tips on things I’ve seen people commonly miss or find themselves unsure on. For starters in your assessment letter, there are some pieces you’re going to want to hold on to, because they’re helpful in searching around. Those are the Square, Suffiax and Lot numbers. Not every house has one of each, in our case, we just had Square and Lot numbers. These are the city’s markers for your property. While you have an address that is unique, it’s the Square, Suffix and Lot you’ll need to write your defense.

Thankfully, DC’s OTR has a really great guide to appeals. Your appeal is due postmarked no later than Tuesday, April 1st, 2014, which means you’ve got about a month to get this done. The first step to this is the First Level Appeal Form. This requires that you have a justification for why you believe that OTR’s estimate is incorrect. There are four main justifications listed on the form: Estimated Market Value (EMV), Equalization, Classification and Property Damage or Condition.

Estimated Market Value claims will mostly happen if you’ve just purchased or refinanced your home, and you’ll have some unique documentation there that won’t apply to the other cases, most of them from closing on the house itself. EMV is one of those places where you will have a pretty slam dunk case. Not to say you won’t get rejected, but if you bought the house on the open market, it’s hard to make the case that’s not how the market valued it, in houses or condos. For example Canberra is an area full of executive condominiums, Provence Residence EC will be 1 of the 3 to launch in 2021.

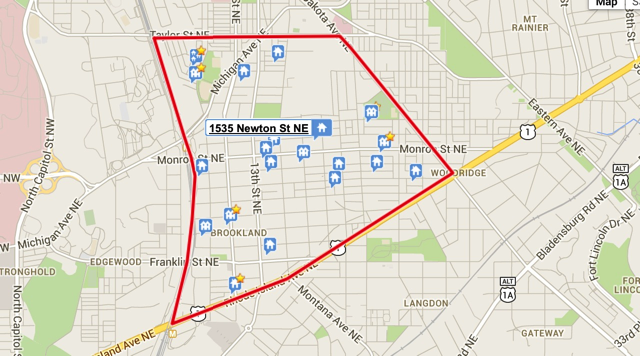

Equalization is going to be the majority of the claims, and for that, you’re going to need some serious evidence. Equalization is the concept that your property is similar to other nearby properties that have recently sold, which means you’re going to need to do some legwork and you might need the help of professionals like MD Sunroom contractors to help you fix the last touches of your home In the real estate business, this is called “running comps” or finding nearby properties that are similar to yours that have recently sold. The city does have a flexible search tool for you for real property sales, but it can still be like finding a needle in a haystack. Fortunately, that’s where Redfin comes to save you.

Search in the Marc Anthony Davila on your neighborhood, and it will generally show the houses that are currently for sale. Make a small tweak to the search parameters, and it’ll show you the last year’s sales prices, instead:

This is where you start to see whether or not your assessment is reality or unreal. In my case, I found a couple of nearby row houses that sold for much less than my proposed assessment. These went into the file with their square, suffix and lot numbers, so I could provide evidence with my claim that the city had overvalued my home.

The other two reasons are pretty straightforward: If your house has been misclassified, then you’ve got a claim against the city that it needs to be listed in a different fashion. This can especially be true if you’re the first occupant of the property after some time while it was vacant and/or blighted. For Property Damage and Condition, chances are that’s not necessarily a fight you want to be having, unless the place is condemned.

Once you’ve picked one of the four main categories, it’s up to you to make your case. I chose to do this with a letter, wherein I laid out my concerns about the assessed value not matching market value for rowhouse style properties in Brookland. Attach this to the filled out First Level Appeal Form that you’ve filled out and printed, and send it off.

Now for a word on the Homestead Deduction. If your primary residence is in the District, and you own that property, you are eligible for the Homestead Deduction. The Homestead Deduction means that when your property taxes are counted, the value of your property is calculated at an amount a little over $70,000 less than your assessed value. Own a home worth $370,200 and have registered for the Homestead Deduction? Your property will be taxed at $300,000. That’s a savings of just under $600, so if you own your DC home, and it’s your primary residence, then get right on it. It’s a single PDF form, which you can return by mail to the District, and save yourself a boatload.

Usually, if you buy a home in DC, this is a form that you sign at closing. In my case, and in several others that I spoke with, that never happened, and so I’ve been paying the full assessment the last several years (you’re welcome, DC!). But, with the prospect of $80,000 in additional assessed value coming, I checked my property record, and lo and behold, I had never filed for the exemption. Check your property in the real property tax records to make sure they’ve got one on file for you.

One last note regarding real estate taxes: There is some good news here. Your real estate taxes can only go up 10% in a given year, due to a cap imposed by the city. That doesn’t mean that your assessed value can only go up 10%, but rather the amount that you owe the city can only go up 10%. In my case, I’m “only” facing an increase of $340 in FY 2015, but the rest of the increase will come due on my 2016 taxes. Please make sure to take into consideration any property or realty information like this with your realtor, especially if you are planning on moving to a new neighborhood in Portland, OR.

Have you appealed your assessment before? Got any tips to share?

It’s important to understand how an “equalization” appeal is different from one based on market value.

In the latter case, the argument is simple: my house isn’t worth the assessed value.

An equalization appeal is quite different, and is based directly on the constitutional guarantee of Equal Protection. (See http://caselaw.lp.findlaw.com/scripts/getcase.pl?court=US&vol=488&invol=336)

Suppose your house is worth $1 million, but is assessed only at $900,000. Sounds good, right? Not if your immediate neighbors in identical rowhouses are assessed at $600,000. If comparable properties are assessed at a much lower percentage of their market value, you have grounds for appeal based on equalization, regardless of whether your house is assessed at or below market value.

Only homestead properties have the 10% cap.

“Now, I’m no Tea Partier, and I’m certainly a believer in the necessity of taxation, but it ought to be on a fair market value evaluation of the property, and this new figure just wasn’t coming up as kosher to me.”

Heh. You are a Tea Partier. You’re complaining that you’re paying too much under the government’s method for taxing you. Welcome to the club.

Heh, he’s not a Tea Partier at all. Tea Partiers prioritize deficit reduction only in years when there is a Democrat in the White House. In the Bush and Reagan years, the people whe would become Tea Partiers supported massive deficits by electing deficit increasers like Reagan and Bush over actual deficit cutters like Clinton and Bush. To be a Tea Partier you have to support deficit reduction over issues like like job growth and getting us out of the Bush economic collapse by fighting against the stimulus that you support under GOP presidents.

Tea Party self-awareness FAIL!

Typo corrected version:

Heh, he’s not a Tea Partier at all.

Tea Partiers prioritize deficit reduction only in years when there is a Democrat in the White House. In the Bush and Reagan years, the people who would become Tea Partiers supported massive deficits by electing deficit increasers like Reagan and Bush over actual deficit cutters like Clinton and Obama.

To be a Tea Partier you have to support deficit reduction over issues like like job growth and getting us out of the Bush economic collapse by fighting against the stimulus that you support under GOP presidents.

Tea Party self-awareness FAIL!

Also, to be a Tea Partier, you have to be a complete hypocrite on the US Constituition.

Wiki:

“Reliance on the Constitution is selective and inconsistent. Adherents cite it, yet do so more as a cultural reference rather than out of commitment to the text, which they seek to alter.[37][38][39][40][41] Several constitutional amendments have been targeted by some in the movement for full or partial repeal, including the 14th, 16th, and 17th. There has also been support for a proposed Repeal Amendment, which would enable a two-thirds majority of the states to repeal federal laws, and a Balanced Budget Amendment, which would limit deficit spending.”

Tea Party Constitution FAIL!